Rich data, live tracking, online reporting, and video recordings that help make roads safer for everyone are just a few of the benefits of AI dash cams.

Another less obvious advantage is this new generation of devices can also help smooth the often adversarial relationship between fleet operators and their insurance companies and foster a productive win-win relationship that benefits both parties.

The True Cost of a Crash

When running a fleet, keeping people safe is of the highest priority and part of the duty of care for operators. This need for personal safety goes hand-in-hand with maintaining vehicles in tip-top shape and ensuring they are driven correctly.

When an accident occurs, vehicle damage is only the most obvious result of a crash, but there are several other knock-on effects. Liability must be determined, deciding who was at fault, and who must take responsibility for the accident. Video evidence provides a reliable and unbiased witness of how events transpired. If injuries occur, there will be medical expenses to pay, and in the event of a death, there would have to be a long investigation. Vehicle repairs will need to be made, which could range from a minor repair to full vehicle replacement, depending on the severity of the crash. Time off the road costs add up quickly as the vehicle cannot get any work done while in the shop.

The total cost of even a single claim can be high. According to the RMIAA (Rocky Mountain Insurance Information Association) the average cost of an insurance claim ranges from US$1,500 to US$15,000, ignoring other hidden costs. That is a hefty figure, and the insurance companies, according to the article, only foot about 50% of the total expenses incurred for all accidents.

In short, the ideal situation is to have zero accidents. But in real life, that is never the case, so you must reduce the risks with better drivers, combined with accountability and protection against outside forces.

Fleet and Insurer Cooperation

Insurance companies want to pay out less and fleet managers want to pay lower premiums, but everyone wants fewer accidents. Fortunately, with the advent of cloud-enabled AI dash cams, it is now possible to achieve all these goals through some innovative approaches not possible with older dash cams.

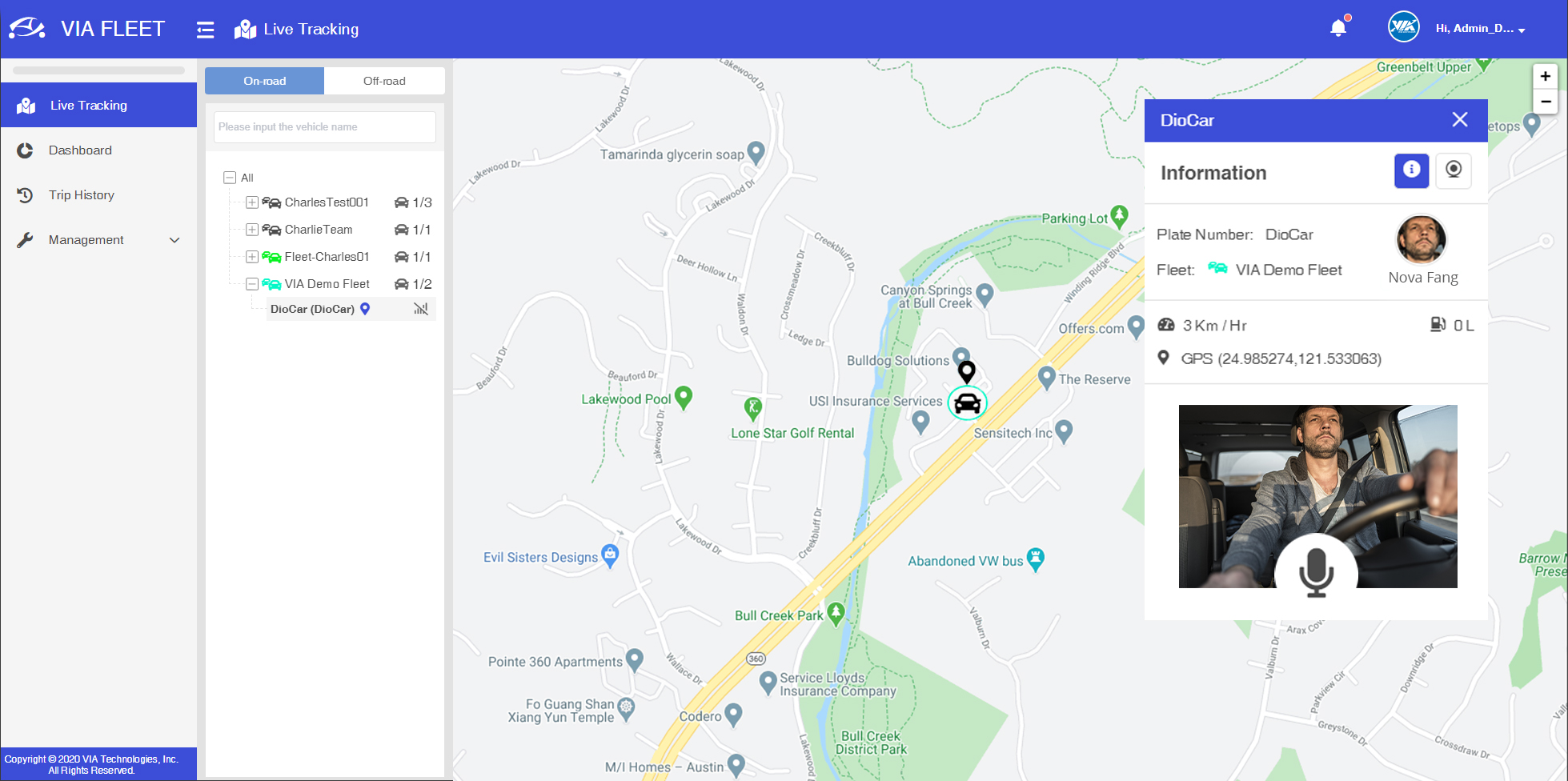

AI dash cams like the VIA Mobile360 D700 and the data they collect can use algorithms to determine which drivers are more reckless. Fleet managers can then take decisive action for underperforming drivers by requiring skills improvement or driver training. They can then let the insurance company know, giving them peace of mind that positive steps are being taken to improve overall fleet safety.

Insurers don’t need to “just trust” the fleet manager’s word because data accessibility makes all these improvements measurable and completely transparent. The fleet manager can present the insurer with concrete statistics that demonstrate overall trends. Fewer driver distraction warnings, fewer speed warnings, consistent following distances, fewer hard turns, and less hard braking indicate improvements in driver safety. These reductions can be substantiated to insurers with collected data.

If, despite all efforts, there is still an accident, claims are easier than ever for both fleet managers and the insurance company. There is video footage of both the inside and outside of the vehicle to determine liability accurately. Instead of watching hours of video to find a crash recording, that crash footage is easily located because of automatic collision warnings and markers. That video evidence is quickly shared with the insurer because it is automatically marked and available through the cloud.

Safer for Everyone

Insurers can make more accurate determinations of fault for any accidents that occur, they can more reliably evaluate their risk, and simplify the claims process. Fleet operators improve their overall safety numbers, reduce collisions, and can work with their insurance company to reduce insurance premiums. By harnessing the many benefits of AI dash cams, insurers and fleet operators have an exciting opportunity to create “win-win” relationships that not only reduce overall costs but also make the roads safer for everyone.

VIA Mobile360 D700 AI Dash Cam

In recent years VIA has garnered extensive feedback from customers operating in the broader Fleet Management sector. This has given us valuable insights that have helped hone our approach to product development. The result is the VIA Mobile360 AI Dash Cam, a full-featured, compact dual-camera device with support for Forward Collision Warning, Lane Departure Warning, and an advanced Driver Safety System. The VIA Mobile360 D700 is AWS IoT Core Qualified and AWS Kinesis Video Streams Qualified. It comes with a 30-day free trial of the VIA Fleet Cloud Management Portal powered by Amazon Web Services (AWS), including 50 hours of live streaming with Amazon KVS.

Learn more about the VIA Mobile360 D700 AI Dash Cam here.

You can also watch this short introductory video: